The term "net worth" refers to the total value of an individual's assets minus their liabilities. It is a measure of financial health and can be used to assess an individual's financial well-being.

There are a number of factors that can affect an individual's net worth, including their income, expenses, investments, and debt. It is important to monitor your net worth over time to ensure that you are making progress towards your financial goals.

There are a number of ways to increase your net worth, including:

- Increasing your income

- Decreasing your expenses

- Investing your money wisely

- Paying down your debt

By following these tips, you can increase your net worth and improve your financial health.

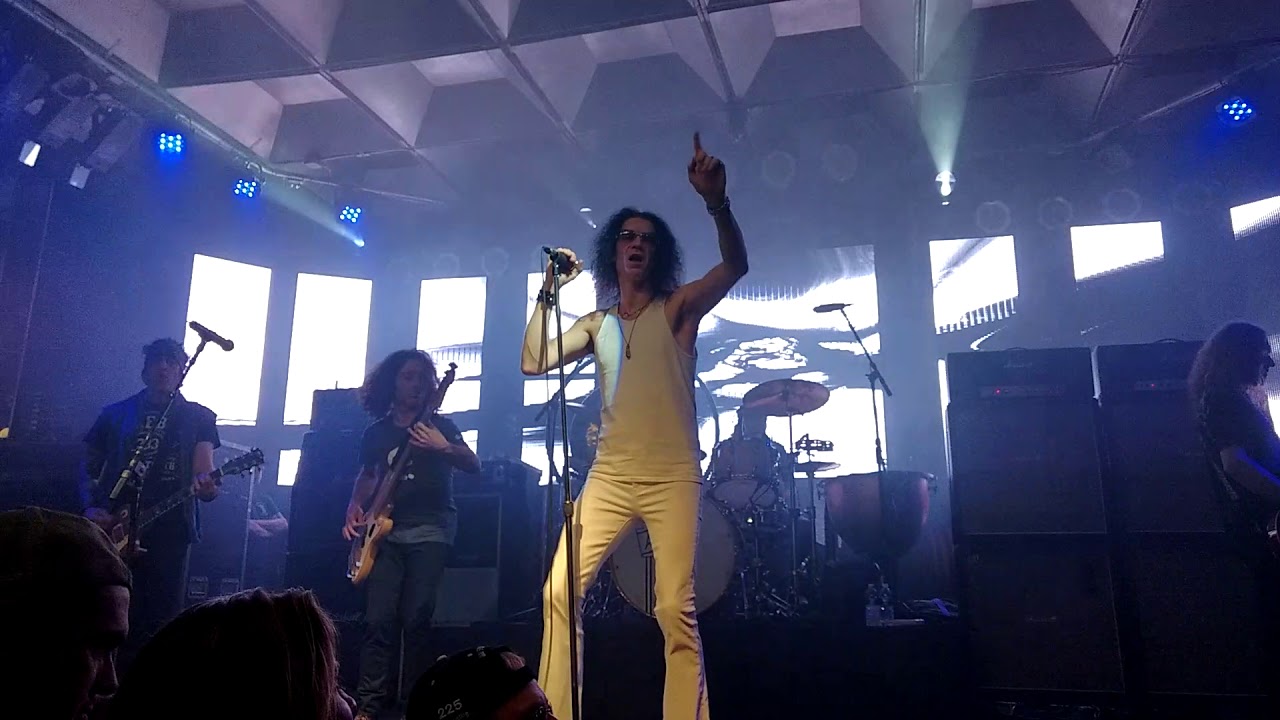

get the led out net worth

The term "net worth" refers to the total value of an individual's assets minus their liabilities. It is a measure of financial health and can be used to assess an individual's financial well-being.

- Assets: These are anything that has value and can be converted into cash. Examples include cash, stocks, bonds, real estate, and personal belongings.

- Liabilities: These are debts that you owe to others. Examples include credit card debt, student loans, and mortgages.

- Income: This is the money that you earn from your job, investments, or other sources.

- Expenses: These are the costs that you incur, such as housing, food, transportation, and entertainment.

- Savings: This is the money that you have set aside for future use.

- Investments: These are assets that you purchase with the hope of making a profit. Examples include stocks, bonds, and real estate.

- Debt: This is money that you owe to others. Examples include credit card debt, student loans, and mortgages.

- Financial goals: These are the financial objectives that you want to achieve, such as buying a house, retiring early, or saving for your children's education.

By understanding these key aspects of net worth, you can better manage your finances and achieve your financial goals.

1. Assets

Assets are an important part of net worth because they represent the value of what you own. The more assets you have, the higher your net worth will be. There are many different types of assets, including cash, stocks, bonds, real estate, and personal belongings. Each type of asset has its own unique characteristics and risks. For example, cash is a very liquid asset, which means that it can be easily converted into cash. However, cash also has a low rate of return. Stocks are a more volatile asset, but they also have the potential to generate a higher rate of return. Real estate is a less liquid asset, but it can also be a good investment over the long term.

It is important to diversify your assets so that you are not too heavily invested in any one type of asset. Diversification can help to reduce your risk and improve your overall return. For example, you might invest some of your money in cash, some in stocks, and some in real estate. This will help to ensure that you are not too heavily invested in any one type of asset and that you are more likely to achieve your financial goals.

Assets are an important part of net worth and can help you to achieve your financial goals. By understanding the different types of assets and how to diversify your portfolio, you can increase your chances of success.

2. Liabilities

Liabilities are an important part of understanding net worth because they represent the amount of money that you owe to others. The more liabilities you have, the lower your net worth will be. It is important to manage your liabilities carefully so that you do not get into financial trouble.

There are many different types of liabilities, including:

- Credit card debt

- Student loans

- Mortgages

- Car loans

- Personal loans

Each type of liability has its own unique characteristics and risks. For example, credit card debt typically has a high interest rate, which can make it difficult to pay off. Student loans typically have a lower interest rate, but they can be a long-term obligation. Mortgages are typically secured by your home, which means that you could lose your home if you default on your loan.

It is important to carefully consider your liabilities before you take on any new debt. Make sure that you can afford the payments and that you understand the risks involved. If you are struggling to manage your liabilities, there are many resources available to help you, such as credit counseling and debt consolidation.

Understanding your liabilities is an important part of managing your finances and achieving your financial goals. By carefully managing your liabilities, you can improve your net worth and financial well-being.

3. Income

Income is an important part of net worth because it is the money that you use to pay your expenses and save for the future. The more income you have, the higher your net worth will be. There are many different ways to increase your income, including:

- Getting a higher-paying job: This is one of the most direct ways to increase your income. You can either ask for a raise at your current job or look for a new job that pays more.

- Starting a side hustle: A side hustle is a way to earn extra money outside of your regular job. There are many different side hustles that you can start, such as freelance writing, driving for Uber, or starting your own online business.

- Investing: Investing is a great way to grow your money over time. There are many different ways to invest, such as stocks, bonds, and real estate. If you are not sure how to get started, you can talk to a financial advisor.

Increasing your income is a great way to improve your net worth and financial well-being. By following the tips above, you can increase your income and achieve your financial goals.

4. Expenses

Expenses are an important part of net worth because they represent the costs that you incur in order to live. The more expenses you have, the lower your net worth will be. It is important to manage your expenses carefully so that you do not spend more money than you earn. There are many different ways to reduce your expenses, including:

- Create a budget: A budget is a plan for how you will spend your money each month. By creating a budget, you can track your income and expenses and make sure that you are not spending more money than you earn.

- Reduce unnecessary expenses: Take a close look at your expenses and identify any areas where you can cut back. For example, you could cancel unused subscriptions, eat out less often, or find cheaper ways to entertain yourself.

- Negotiate lower bills: You may be able to negotiate lower bills for some of your expenses, such as your rent or your cell phone bill. Contact your service providers and see if you can get a better deal.

Reducing your expenses is a great way to improve your net worth and financial well-being. By following the tips above, you can reduce your expenses and achieve your financial goals.

In conclusion, expenses are an important part of net worth. By managing your expenses carefully, you can improve your net worth and financial well-being.

5. Savings

Savings are an important part of net worth because they represent the money that you have set aside for future use. The more savings you have, the higher your net worth will be. There are many different ways to save money, including:

- Setting up a budget: A budget is a plan for how you will spend your money each month. By creating a budget, you can track your income and expenses and make sure that you are saving enough money each month.

- Automating your savings: You can set up automatic transfers from your checking account to your savings account each month. This will help you to save money without even thinking about it.

- Investing your savings: Investing is a great way to grow your savings over time. There are many different ways to invest, such as stocks, bonds, and real estate. If you are not sure how to get started, you can talk to a financial advisor.

Saving money is an important part of building wealth and achieving your financial goals. By following the tips above, you can increase your savings and improve your net worth.

6. Investments

Investments are an important part of net worth because they can help you to grow your wealth over time. When you invest, you are essentially buying a piece of a company or other asset with the hope that it will increase in value. If the investment does well, you can make a profit. However, it is important to remember that investments can also lose value, so it is important to diversify your portfolio and invest only what you can afford to lose.

There are many different types of investments, each with its own unique risks and rewards. Some of the most common types of investments include:

- Stocks: Stocks represent ownership in a company. When you buy a stock, you are essentially buying a small piece of that company. Stocks can be a good investment over the long term, but they can also be volatile in the short term.

- Bonds: Bonds are loans that you make to a company or government. When you buy a bond, you are essentially lending money to the issuer. Bonds typically pay a fixed interest rate, and they can be a good way to generate income and preserve capital.

- Real estate: Real estate is land and the buildings on it. Real estate can be a good investment over the long term, but it can also be illiquid and expensive to maintain.

The type of investment that is right for you will depend on your individual circumstances and financial goals. It is important to do your research and understand the risks involved before investing any money.

Investing is an important part of building wealth and achieving your financial goals. By understanding the different types of investments and how to diversify your portfolio, you can increase your chances of success.

7. Debt

Introduction: Debt is an important factor to consider when calculating your net worth. The more debt you have, the lower your net worth will be. This is because debt represents a liability, or something that you owe to someone else. When you have a lot of debt, it can be difficult to save money and build wealth.

- Facet 1: Credit Card Debt

Credit card debt is a common type of unsecured debt. This means that it is not backed by any collateral, such as a house or car. Credit card debt can be very expensive, as interest rates are often high. If you carry a balance on your credit cards, it can be difficult to get out of debt.

- Facet 2: Student Loans

Student loans are another common type of debt. Student loans can be either federal or private. Federal student loans typically have lower interest rates than private student loans. However, both types of student loans can be a burden, especially if you have a lot of debt.

- Facet 3: Mortgages

Mortgages are secured loans that are used to purchase a home. Mortgages typically have lower interest rates than other types of loans. However, mortgages can also be a significant financial burden, especially if you have a large mortgage.

- Facet 4: Debt Consolidation

Debt consolidation is a process of combining multiple debts into a single loan. This can be a good way to get a lower interest rate and make it easier to manage your debt. However, debt consolidation is not always the best option. It is important to talk to a financial advisor to see if debt consolidation is right for you.

Conclusion: Debt is an important factor to consider when calculating your net worth. The more debt you have, the lower your net worth will be. If you have a lot of debt, it is important to take steps to reduce your debt and improve your financial health.

8. Financial goals

Financial goals are an important part of net worth because they provide a roadmap for how you want to use your money. When you have clear financial goals, you can make better decisions about how to save and invest your money. Achieving your financial goals can also help you to increase your net worth.

- Buying a house: Buying a house is a common financial goal for many people. When you buy a house, you are building equity in an asset that can appreciate in value over time. This can be a great way to increase your net worth.

- Retiring early: Retiring early is another common financial goal. When you retire early, you will need to have enough money saved to support yourself for the rest of your life. This means that you will need to have a high net worth.

- Saving for your children's education: Saving for your children's education is a long-term financial goal. However, it is important to start saving early so that you can have enough money to cover the costs of college or other higher education expenses.

These are just a few examples of financial goals that you may have. When you set financial goals for yourself, it is important to make sure that they are realistic and achievable. You should also regularly review your financial goals and make adjustments as needed.

FAQs on "get the led out net worth"

This section addresses frequently asked questions and clears up common misconceptions, providing a comprehensive understanding of "get the led out net worth."

Question 1: What exactly is "net worth"?

Net worth represents the total value of an individual's assets minus their liabilities. In essence, it measures one's financial well-being.

Question 2: Why is it crucial to monitor net worth over time?

Tracking net worth over time allows individuals to gauge their progress towards achieving financial goals. It also helps them identify areas where they can improve their financial health.

Question 3: What are some effective strategies to boost net worth?

Increasing income, reducing expenses, investing wisely, and paying down debt are all effective strategies for accumulating wealth and increasing net worth.

Question 4: How can individuals effectively manage their liabilities or debts?

Prudent management of liabilities involves carefully considering new debt obligations, understanding the terms and risks involved, and exploring options like debt consolidation to reduce interest rates and streamline payments.

Question 5: What role do investments play in building net worth?

Investments, such as stocks, bonds, and real estate, provide opportunities to grow wealth over time. Diversifying investments across different asset classes helps spread risk and potentially enhance returns.

Question 6: How do financial goals align with net worth?

Establishing clear financial goals, such as saving for retirement or a down payment on a house, provides direction and motivation for managing finances. Achieving these goals contributes to building a stronger net worth.

These FAQs provide valuable insights into "get the led out net worth," empowering individuals to better understand and manage their financial situation.

Transition to the next article section: Understanding the intricacies of net worth is a cornerstone of sound financial planning. By embracing the principles discussed in this article, individuals can make informed decisions, set realistic goals, and ultimately achieve long-term financial success.

Tips to Enhance Your Net Worth

Enhancing your net worth requires strategic financial planning and disciplined execution. Here are several tips to guide you in building a stronger financial foundation:

Tip 1: Establish a Comprehensive Budget

Creating a budget is crucial for tracking income and expenses, enabling you to identify areas for potential savings and smarter spending decisions.

Tip 2: Prioritize High-Yield Savings

Prioritizing high-yield savings accounts can help you accumulate wealth more efficiently. Explore different options to find the most competitive interest rates.

Tip 3: Invest Wisely and Diversify

Diversifying investments across various asset classes, such as stocks, bonds, and real estate, helps spread risk and potentially enhance returns.

Tip 4: Manage Debt Responsibly

Managing debt responsibly involves understanding the terms and risks associated with different types of debt, and prioritizing high-interest debts for repayment.

Tip 5: Seek Professional Financial Advice

Consulting a qualified financial advisor can provide personalized guidance tailored to your specific financial goals and circumstances, maximizing your chances of success.

Tip 6: Regularly Review and Adjust

Your financial situation and goals may evolve over time, necessitating regular reviews and adjustments to your financial plan to ensure alignment with your objectives.

By incorporating these tips into your financial strategy, you can work towards building a stronger net worth, securing your financial future, and achieving your long-term financial aspirations.

Conclusion

Understanding and enhancing your net worth is fundamental to achieving financial stability and long-term success. "Get the led out net worth" emphasizes the significance of managing your assets, liabilities, income, expenses, savings, investments, and financial goals effectively. By implementing the strategies discussed throughout this article, you can build a stronger financial foundation, secure your financial future, and achieve your long-term financial aspirations.

Remember, financial planning is an ongoing process that requires regular review and adjustment. Stay informed about financial trends, seek professional advice when needed, and make informed decisions to maximize your net worth. By embracing these principles, you can unlock your financial potential and pave the way for a more secure and prosperous financial future.

You Might Also Like

Discover The Estimated Net Worth Of Renowned Musician Jim JamesThe Comprehensive Guide To C.J. Box's Net Worth

Chad And Erin Paine: Unveiling Their Staggering Net Worth

Uncovering The Wealth Of Joanne Herring: Exploring Her Net Worth

Uncovering The Current Whereabouts Of Pioneer Quest's Stars In 2022

Article Recommendations

- Victoria Principal Children Insights Into Family Life

- Exploring The Fascinating Journey Of Gorilla Glue Girl Net Worth

- Kelly Ripa Salary Per Episode An Indepth Look At Her Earnings And Career