Introduction to Import Fees

In today's globalized economy, import fees have become an integral part of international trade. Whether you're a business owner importing goods for resale or an individual purchasing items from overseas, understanding import fees is crucial. These fees can significantly impact the cost of goods, and being informed can help you make smarter purchasing decisions. In 2024, with evolving trade policies and international agreements, staying updated on import fees is more important than ever. This article aims to demystify import fees, providing a clear picture of what they entail and how they can affect your transactions.

What Are Import Fees?

Import fees are charges imposed by a country's government on goods brought into its borders. These fees are intended to protect domestic industries, generate revenue, and regulate the flow of goods. Import fees can include customs duties, taxes, and additional charges that vary depending on the type of goods, their value, and the country of origin. Understanding these fees is essential for anyone dealing with international trade, as they can add a significant amount to the final cost of imported goods. By comprehending what makes up import fees, you can better anticipate the costs associated with importing goods into your country.

Components of Import Fees

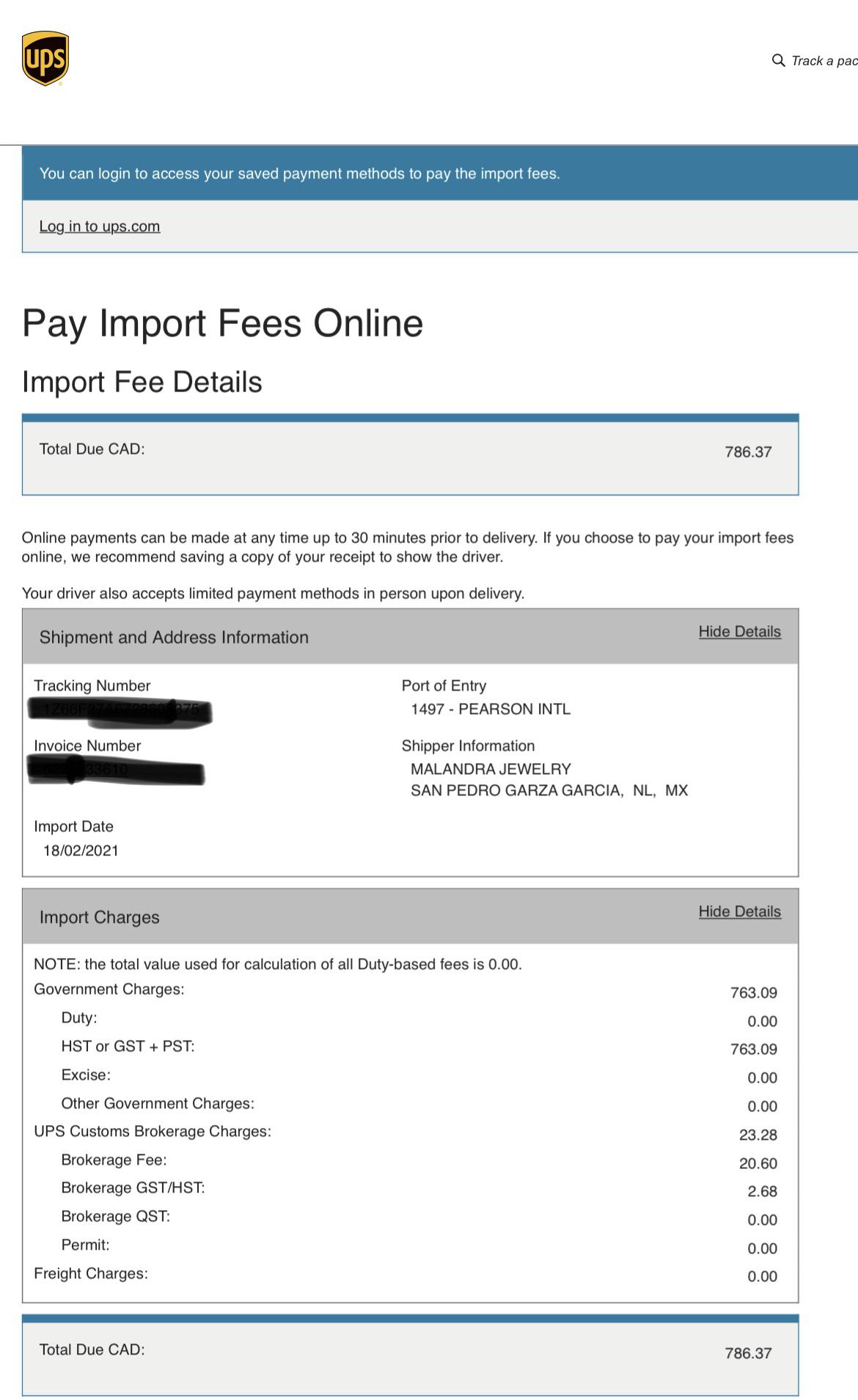

Import fees typically comprise several components. The most common is customs duties, which are taxes levied on imported goods based on their classification and value. Another component is value-added tax (VAT) or goods and services tax (GST), which is applied at the point of entry. Additional charges may include processing fees, brokerage fees, and compliance fees. Each of these components can vary depending on the country and the specific goods being imported. By breaking down these components, importers can gain a clearer understanding of the total costs involved and plan their budgets accordingly.

How Are Import Fees Calculated?

The calculation of import fees can be complex, as it depends on various factors such as the type of goods, their value, and the country of origin. Most countries use the Harmonized System (HS) to classify goods, which determines the applicable duty rates. The value of the goods is typically assessed based on the transaction value, which includes the cost of the goods, insurance, and freight. Depending on the country, importers may also need to comply with specific documentation requirements to ensure accurate calculation of fees. Understanding how import fees are calculated can help importers avoid unexpected costs and streamline their import processes.

Strategies to Minimize Import Fees

There are several strategies that importers can employ to minimize import fees. One approach is to explore trade agreements between countries, which may offer reduced duty rates or exemptions for certain goods. Importers can also consider consolidating shipments to reduce the frequency of import transactions, thereby minimizing processing fees. Another strategy is to properly classify goods to ensure accurate duty assessments and avoid overpayment. By implementing these strategies, importers can effectively manage their import costs and enhance their competitive advantage in the market.

Impact of Import Fees on Businesses

For businesses engaged in international trade, import fees can have a significant impact on profitability. High import fees can increase the cost of goods, making them less competitive in the market. Businesses must carefully factor in these costs when pricing their products to maintain their profit margins. Additionally, import fees can influence supply chain decisions, such as sourcing and inventory management. Understanding the impact of import fees on business operations can help companies develop strategic plans to mitigate these costs and optimize their supply chains.

Impact on Consumers

Import fees also affect consumers, as they can lead to higher prices for imported goods. When businesses incur high import fees, they may pass these costs on to consumers, resulting in increased retail prices. Consumers should be aware of the potential impact of import fees on the products they purchase, especially when buying from overseas. By staying informed about import fees, consumers can make more informed purchasing decisions and seek out cost-effective alternatives if necessary.

Changes in Import Fees in 2024

As we move into 2024, changes in international trade policies and agreements may influence import fees. Countries are continually negotiating trade agreements that can alter duty rates and exemption criteria. It's essential for importers and consumers to stay informed about these changes to understand their implications on import fees. Keeping abreast of policy updates and consulting with experts can help stakeholders navigate the complexities of import fees in the evolving trade landscape of 2024.

Conclusion

Import fees are a critical consideration for anyone involved in international trade, whether importing goods for business or personal use. By understanding what import fees entail, how they are calculated, and their impact on businesses and consumers, stakeholders can better manage their import transactions. As trade policies continue to evolve, staying informed about changes in import fees will be key to maintaining competitiveness and making informed purchasing decisions in 2024. Armed with this knowledge, importers and consumers can navigate the complexities of international trade with confidence.

You Might Also Like

Mastering The Art Of "Masters I": A Guide For 2024Understanding Long Mononucleosis: A Comprehensive Guide For 2024

The Ultimate Guide To Understanding The C Degree In 2024

2029 Meteor: What We Know And How To Prepare

Unlocking The Secrets Of Key Wiki: A Comprehensive Guide For 2024

Article Recommendations

- Black Lab Pit Mix Lifespan Average Factors Affecting It

- Unraveling The Life And Legacy Of Kyle Van Noys Parents

- Unveiling The Intriguing Journey And Net Worth Of Charles Ramsey